Should You Pay Off Your Mortgage Early? Pros and Cons

When it comes to homeownership, one of the most significant financial decisions you’ll face is whether to pay off your mortgage early or stick to the regular payment schedule. Many homeowners are tempted by the idea of being mortgage-free, while others prefer to use their extra funds for investment or savings. There’s no one-size-fits-all answer, and whether or not paying off your mortgage early is the right choice depends on your unique financial situation, goals, and preferences.

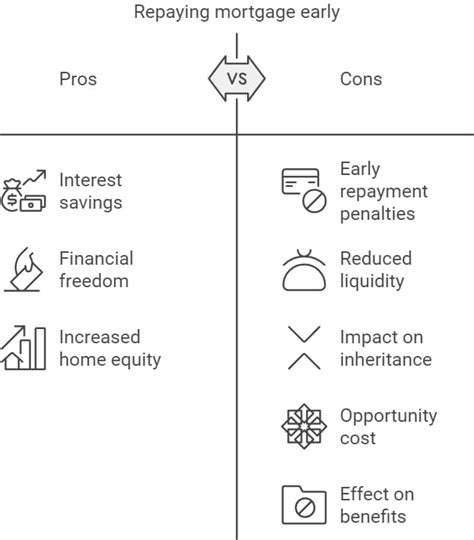

In this article, we'll explore the pros and cons of paying off your mortgage early to help you make an informed decision.

The Pros of Paying Off Your Mortgage Early

Peace of Mind and Financial Freedom

One of the most appealing benefits of paying off your mortgage early is the peace of mind that comes with being debt-free. Without a monthly mortgage payment, you might feel a sense of financial freedom and security. This can be especially comforting during periods of economic uncertainty, as you’ll be less reliant on fluctuating income or interest rates.

Save Money on Interest

Mortgage interest can add up over time, especially if you have a long loan term (e.g., 30 years). By paying off your mortgage early, you reduce the total interest paid over the life of the loan. For example, if you have a 30-year mortgage and make extra payments toward the principal, you could save tens of thousands of dollars in interest payments, depending on the size of your loan and interest rate.

Increased Equity

By paying down your mortgage early, you increase the equity in your home. This can be advantageous if you plan to sell or refinance the home later on. More equity means you’ll owe less when it’s time to move, and you’ll have a larger cash balance from the sale.

Stronger Retirement Security

For homeowners planning for retirement, paying off the mortgage early can make a huge difference. Once the mortgage is paid off, your monthly expenses are reduced, meaning you’ll need less income in retirement. This can provide greater flexibility in how you structure your post-work years, whether that’s retiring earlier, downsizing, or having more disposable income to enjoy.

Increased Financial Flexibility

Without a mortgage payment, you have more financial flexibility to pursue other goals, whether that’s traveling, investing in other assets, or saving for future needs. This can provide a sense of financial empowerment, as your fixed costs decrease, and you gain more control over your budget.

The Cons of Paying Off Your Mortgage Early

Opportunity Cost

One of the biggest downsides to paying off your mortgage early is the opportunity cost of that money. Rather than using your extra funds to pay down the mortgage, you could invest that money elsewhere. Historically, the stock market has yielded higher returns than the interest rate on most mortgages. For example, if your mortgage rate is 4% and you could potentially earn an 8% return by investing, you could be better off investing rather than paying off the loan early.

This can be a particularly compelling argument for younger homeowners or those with a longer time horizon until retirement, as the power of compound interest may far outweigh the savings from mortgage interest.

Reduced Liquidity

Paying off your mortgage early ties up a significant portion of your cash in an illiquid asset—your home. While home equity can be tapped through refinancing or a home equity line of credit (HELOC), doing so may not be as simple or fast as accessing other forms of savings or investments. If an emergency arises and you need cash quickly, you may not have enough liquidity to cover it without taking on debt again.

Tax Deductions Lost

For those who itemize deductions, mortgage interest payments can reduce taxable income, leading to potential tax savings. If you pay off your mortgage early, you’ll lose this deduction, which may lead to higher taxes. However, this depends on the size of your mortgage and your overall tax situation, so for some people, the tax benefits may be relatively small.

Potential Prepayment Penalties

Some mortgages come with prepayment penalties if you pay off your loan early or make significant extra payments. These penalties are designed to protect lenders from losing interest income, but they can make paying off your mortgage early less financially advantageous. Be sure to review the terms of your mortgage agreement before making extra payments.

Missed Investment Opportunities

If you have access to retirement accounts, such as a 401(k) or IRA, you may benefit more from contributing extra funds to these accounts rather than using that money to pay down your mortgage. These accounts often offer tax advantages and the potential for higher returns. By prioritizing your mortgage over retirement savings, you might miss out on opportunities to grow wealth in a tax-efficient way.

Factors to Consider When Deciding

Mortgage Interest Rate

If your mortgage has a low interest rate (e.g., 3-4%), paying it off early may not provide as significant a financial benefit as investing that money elsewhere. In contrast, if your mortgage rate is high, such as 6% or more, paying off the mortgage early can yield a greater return by eliminating high-interest debt.

Your Financial Goals

Your financial goals play a crucial role in this decision. If becoming debt-free is a high priority for you, paying off the mortgage early may offer more peace of mind than any financial strategy. On the other hand, if you’re focused on wealth-building through investments, then prioritizing investing over paying off the mortgage might align better with your objectives.

Emergency Fund and Other Debts

Before committing extra funds to your mortgage, ensure you have an adequate emergency fund and no high-interest debt (such as credit card balances). It’s generally a good idea to have 3-6 months’ worth of living expenses saved up before making extra mortgage payments. Additionally, paying off high-interest debt like credit cards should take precedence over paying off your mortgage.

Tax Situation

Consider how paying off your mortgage early will impact your taxes. If you rely on mortgage interest deductions and itemize deductions, paying off your mortgage may increase your taxable income. However, the impact of losing this deduction might be relatively small compared to the long-term benefits of being debt-free.