How to Build Passive Income Streams to Secure Your Future

In an ever-changing economic landscape, relying solely on a traditional 9-to-5 job can feel risky. Whether it's the uncertainty of job security, inflation, or simply the desire for more financial freedom, many people are exploring passive income as a way to secure their financial future. Building passive income streams allows you to earn money with minimal ongoing effort after the initial setup. It’s a powerful tool that can provide you with more financial flexibility, greater savings, and even the ability to retire early or work less.

If you're ready to take control of your financial future and create a stable income that works for you, here’s a comprehensive guide on how to build passive income streams that can secure your future.

Understand the Concept of Passive Income

Before diving into the methods, it’s important to understand what passive income really means. Unlike active income (earned from working a job), passive income comes from investments or business models that require little day-to-day effort once set up.

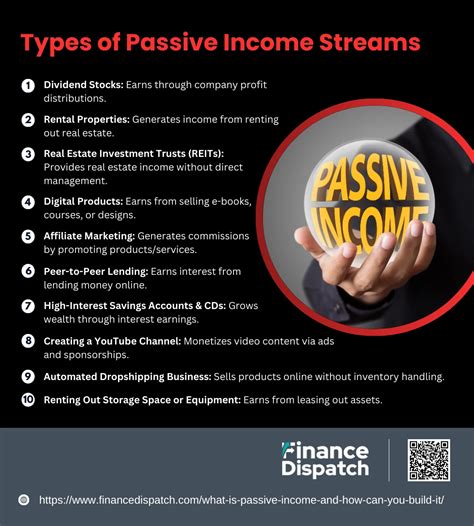

Common examples of passive income include:

- Earnings from rental properties

- Royalties from books, music, or intellectual property

- Dividends from stocks

- Income from online businesses

- Interest from savings accounts or peer-to-peer lending

The goal is to create a system where money flows in with minimal active involvement from you.

Identify Your Passive Income Goals

Not all passive income streams are the same. Some require significant upfront investments of time, money, or effort, while others are more hands-off. Identifying your goals and what you’re willing to invest is a critical first step.

Ask yourself these questions:

- How much money do I want to make? Your financial target will determine the level of effort and capital required.

- How much time can I commit upfront? Some passive income streams require months or years to develop, while others can start generating income much quicker.

- What risks am I willing to take? All investments come with risks. Make sure you’re comfortable with the level of risk involved in each option.

- What skills or assets do I have? Some passive income streams require specific knowledge or access to resources, such as a property to rent out or expertise to create an online course.

Once you have a clear understanding of your goals, you can explore passive income strategies that best align with your resources and risk tolerance.

Start with Dividend Stocks or REITs

One of the simplest ways to start building passive income is through investing in stocks that pay dividends or real estate investment trusts (REITs). Both options allow you to earn regular payouts without needing to actively manage a business or investment.

Dividend Stocks:

When you invest in dividend-paying stocks, you receive a share of the company’s profits, usually on a quarterly basis. This is a low-effort way to generate passive income once you have built up a portfolio. Over time, as your portfolio grows, so too will your dividend payouts.

Real Estate Investment Trusts (REITs):

REITs allow you to invest in real estate without the hassle of owning property. These companies own and manage income-generating real estate, and they distribute most of their earnings as dividends. REITs can be a great way to earn passive income from real estate without dealing with tenants, maintenance, or property management.

Action Steps:

- Research solid dividend-paying stocks or high-yield REITs.

- Diversify your portfolio to spread risk across various industries or types of real estate.

- Reinvest your dividends to accelerate your returns over time.

Create an Online Business or Digital Products

Building an online business is one of the best ways to generate passive income with relatively low initial costs. Once you have a business in place, many online income streams require minimal active involvement. Here are a few popular online businesses that can generate passive income:

Digital Products:

Creating digital products like eBooks, online courses, stock photos, or printables can generate significant passive income. Once you create the product, it can be sold repeatedly with little additional effort. Websites like Amazon, Udemy, or Etsy make it easy to distribute digital products to a wide audience.

Affiliate Marketing:

Affiliate marketing involves promoting other people’s products and earning a commission for sales or leads you generate. You can build a website, blog, or YouTube channel around a specific niche, then include affiliate links in your content. If someone makes a purchase using your link, you earn a commission.

Blogging or YouTube:

Both blogging and YouTube can generate passive income through ads, sponsored content, and affiliate marketing. While these platforms require consistent content creation upfront, they can eventually run on autopilot once you’ve built an audience.

Action Steps:

- Start a blog, YouTube channel, or online store focused on a niche you’re passionate about.

- Create valuable content that will attract a steady stream of visitors.

- Set up monetization methods, like affiliate marketing, ad networks, or digital product sales.

Invest in Real Estate

Real estate is a time-tested method of building passive income. Property can provide steady rental income, and its value may appreciate over time. However, managing properties does require more work than other passive income streams, unless you opt for certain strategies like turnkey properties or property management companies.

Buy-to-Let Properties:

Renting out residential or commercial properties allows you to earn monthly rental income. This can provide a reliable cash flow stream once your properties are rented. However, managing tenants and maintenance can be time-consuming, which is why some property owners hire property management companies to handle day-to-day operations.

Vacation Rentals:

With the rise of platforms like Airbnb and Vrbo, short-term vacation rentals have become a lucrative way to generate passive income. Vacation properties, when properly managed, can yield much higher returns than traditional rental properties, but they may also require more effort in terms of cleaning, guest communication, and occasional maintenance.

Action Steps:

- Begin by researching local real estate markets and identify properties that can generate positive cash flow.

- Consider hiring a property management service if you want to minimize active involvement.

- Keep in mind the upfront costs, including down payments, property taxes, and maintenance.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms like LendingClub or Prosper allow you to lend money to individuals or small businesses in exchange for interest payments. These platforms typically offer higher returns than traditional savings accounts, but they come with higher risk.

As a lender, you can diversify your investments by spreading your funds across multiple loans to mitigate risk. In return, you’ll earn interest on the loans that are paid back.

Action Steps:

- Research different P2P lending platforms and review their fees, risks, and returns.

- Start with a small investment to get familiar with the platform.

- Diversify your loans across different borrowers to reduce risk.

Automate Your Investments

Building passive income doesn’t always mean having to put in hours of research. Automated investing tools like Robo-advisors (e.g., Betterment, Wealthfront) or index funds allow you to invest in a diversified portfolio with minimal effort. These platforms use algorithms to automatically allocate and rebalance your investments based on your risk tolerance and goals.

Action Steps:

- Open an account with a robo-advisor or invest in a low-cost index fund that tracks a broad market index like the S&P 500.

- Set up automatic contributions to your investment account to steadily grow your portfolio.

- Reinvest any dividends or interest to increase your earnings over time.

Build a Strong Emergency Fund

While not technically a "passive income stream," having a well-established emergency fund acts as a financial cushion that can help secure your future. This fund will provide the security you need to take more risks with your passive income ventures.

Aim to save 3 to 6 months' worth of living expenses in a high-yield savings account. Once you have this safety net in place, you’ll be better positioned to take on passive income opportunities without the pressure of needing immediate returns.