Understanding Different Types of Investments: Stocks, Bonds, and More

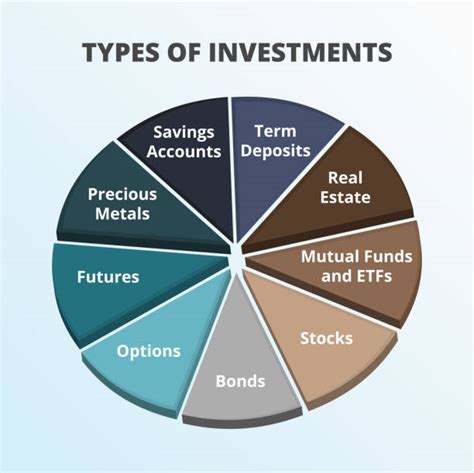

Investing is a powerful way to grow wealth over time, but with so many different investment options available, it can be overwhelming to know where to start. Whether you're a seasoned investor or just beginning to dip your toes into the world of finance, understanding the various types of investments is essential to building a well-rounded portfolio that aligns with your financial goals.

In this article, we’ll break down some of the most common types of investments: stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), and more. We’ll explain the key characteristics, potential returns, and risks associated with each one, helping you make informed decisions based on your risk tolerance, time horizon, and financial objectives.

Stocks (Equities)

What Are Stocks?

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you're purchasing a small share of that company. If the company performs well, the value of its stock typically increases, and you may benefit from both price appreciation and dividend payments.

Potential Returns:

Stocks have historically offered some of the highest returns compared to other investment options. The long-term average annual return for U.S. stocks has been around 7-10%, depending on the market. However, stock prices can be volatile in the short term, with significant fluctuations in value.

Risks:

The main risk with stocks is that their value can go down. Economic downturns, company performance, market sentiment, and geopolitical factors can all negatively impact stock prices. Investors who invest in individual stocks are also exposed to the specific risks of the company or sector they’re invested in. Therefore, stocks are generally considered more risky than other types of investments.

Best For:

- Investors looking for long-term growth potential

- Those who can tolerate short-term volatility

- Investors with a time horizon of at least 5-10 years

Bonds

What Are Bonds?

Bonds are debt securities issued by corporations, municipalities, or governments. When you buy a bond, you’re essentially lending money to the issuer in exchange for regular interest payments and the promise to return your principal (the amount you invested) at the bond’s maturity date.

Potential Returns:

Bonds are generally considered safer than stocks but offer lower returns. The interest rate, known as the bond’s coupon, is typically fixed, meaning you receive predictable payments over the life of the bond. The return on bonds can range from 2-6%, depending on the issuer and bond type.

Risks:

Bonds are less risky than stocks, but they still carry certain risks. Interest rate risk is a significant factor—if interest rates rise, the value of existing bonds tends to fall. Credit risk is another consideration: if the issuer of the bond defaults or experiences financial difficulty, you may not receive the expected interest payments or your principal back.

Best For:

- Conservative investors seeking more stability and lower risk

- Those looking for predictable income, such as retirees

- Investors who are less tolerant of market volatility

Real Estate

What Is Real Estate Investing?

Real estate investing involves purchasing property—residential or commercial—with the intention of earning rental income or profiting from property appreciation. You can invest directly by buying property, or indirectly through real estate investment trusts (REITs).

Potential Returns:

Real estate has the potential for long-term capital appreciation and regular rental income. The average annual return for real estate investments varies widely based on location, property type, and market conditions. Historically, real estate has generated returns between 8-12% annually, though this can fluctuate based on factors like interest rates and the broader economy.

Risks:

Real estate can be illiquid, meaning it may take time to sell a property or access your investment. There’s also the risk of property value declines due to market conditions, location, or unforeseen circumstances (e.g., natural disasters). Real estate investments can also require significant upfront capital and ongoing management expenses.

Best For:

- Investors looking for long-term growth and passive income

- Those willing to commit significant capital or who want diversification in their portfolio

- Investors who understand or are willing to learn about property management

Mutual Funds

What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional portfolio managers who make investment decisions on behalf of the investors.

Potential Returns:

The returns from mutual funds depend on the underlying assets they invest in. Stock-based mutual funds tend to offer higher long-term returns (typically 6-10% annually), while bond-based funds may offer lower returns (3-5%). However, mutual funds provide built-in diversification, which can reduce individual investment risk.

Risks:

The primary risk with mutual funds is that the value of the underlying investments can decline, especially in stock-based mutual funds. Actively managed funds also come with management fees, which can eat into returns. While mutual funds are diversified, they are not risk-free and can still be volatile depending on the asset allocation.

Best For:

- Investors looking for diversification without picking individual stocks or bonds

- Those who prefer a hands-off approach and are willing to pay management fees

- New investors or those looking to invest small amounts regularly

Exchange-Traded Funds (ETFs)

What Are ETFs?

Exchange-traded funds (ETFs) are similar to mutual funds but trade like stocks on stock exchanges. ETFs can be made up of a wide range of assets, including stocks, bonds, or commodities. Like mutual funds, ETFs offer diversification but typically have lower expense ratios.

Potential Returns:

ETFs that track stock indexes (such as the S&P 500) have historically provided long-term returns in the range of 7-10%. Bond ETFs, depending on the bond market, can offer more modest returns (2-5%). Due to their passive nature, ETFs generally have lower management fees than mutual funds.

Risks:

ETFs come with the same risks as the underlying securities they track. If you invest in a stock ETF, the value of the ETF will fluctuate with the stock market. Some ETFs, especially those investing in more volatile sectors or markets, can experience significant price swings.

Best For:

- Investors seeking low-cost, diversified exposure to a specific market or asset class

- Those who want a flexible, liquid investment that can be traded throughout the day

- Investors who prefer a passive investment strategy

Commodities

What Are Commodities?

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, or wheat. You can invest in commodities directly by purchasing the physical goods, or indirectly through commodity futures contracts, ETFs, or mutual funds.

Potential Returns:

Commodities can provide strong returns during periods of high demand or geopolitical instability. Gold, for example, is often seen as a hedge against inflation. However, commodities can be highly volatile, with prices fluctuating based on factors like supply and demand, weather conditions, and global events.

Risks:

Commodities can be subject to sharp price movements, making them risky investments. Additionally, investing in commodities directly (e.g., purchasing physical goods) can be expensive and complicated. Futures contracts also involve high risk and leverage.

Best For:

- Investors looking to hedge against inflation or economic uncertainty

- Those with a higher risk tolerance who are looking for diversification

- Investors with an understanding of the commodities market or those who use ETFs for exposure