How to Use a Cash Envelope System to Control Your Spending

In today’s world of digital payments, it’s easy to lose track of how much money is leaving your wallet. Swiping a card for everything from groceries to coffee can lead to unintentional overspending, making it difficult to stick to a budget. One simple and effective way to regain control over your finances is by using a cash envelope system. This age-old budgeting method helps you physically allocate cash for different spending categories, limiting the temptation to overspend.

If you’re ready to take control of your money, here’s a step-by-step guide on how to use a cash envelope system to control your spending.

Understand the Basics of the Cash Envelope System

The cash envelope system is a budgeting method that involves dividing your income into categories and using cash only for those specific categories. When the cash for a category is gone, you stop spending in that area for the rest of the budget period. This system encourages mindful spending by limiting the amount of money you can use and making you more aware of where your money is going.

The key components of the system:

- Budget categories: You’ll divide your income into categories that reflect your spending needs, such as groceries, entertainment, gas, or dining out.

- Cash: Withdraw cash at the start of each budgeting period (typically monthly) and place the cash into individual envelopes for each category.

- Envelopes: Each envelope represents a specific spending category. You can use physical envelopes, labeled and organized, or digital envelopes using apps that simulate the system.

Determine Your Budget Categories

The first step in using the cash envelope system is to set up your budget categories. These should be areas where you tend to spend most of your money and where you feel it’s easy to overspend. Common categories include:

- Groceries: Money for food and household items.

- Dining Out: Money for restaurants, coffee shops, or fast food.

- Gas/Transportation: Money for fuel or public transportation.

- Entertainment: Money for activities like movies, events, or subscriptions.

- Personal Spending: Money for clothing, cosmetics, or hobbies.

- Miscellaneous: For unexpected or irregular expenses (like gifts or home repairs).

Action Steps:

- Evaluate your spending habits: Look at your past spending to see which categories need more attention.

- Set limits: For each category, decide how much money you want to allocate for the period. This amount should align with your financial goals and current income.

- Leave room for flexibility: Some categories might need a little more flexibility, especially in the case of emergencies or irregular expenses.

Withdraw Cash for Each Category

Once you’ve identified your categories and set limits for each one, withdraw the total amount of cash for the month (or your chosen budget period). The idea is to only spend the cash you’ve set aside, so there’s no risk of overspending by using credit cards or debit cards.

Action Steps:

- Determine the total amount: Add up the cash amounts for each envelope to get the total amount of cash you’ll need to withdraw.

- Use ATMs or banks: Withdraw the cash from your bank, making sure to divide it according to your budgeted categories.

- Have exact amounts: If possible, get the exact denominations to make it easier to carry and use your cash.

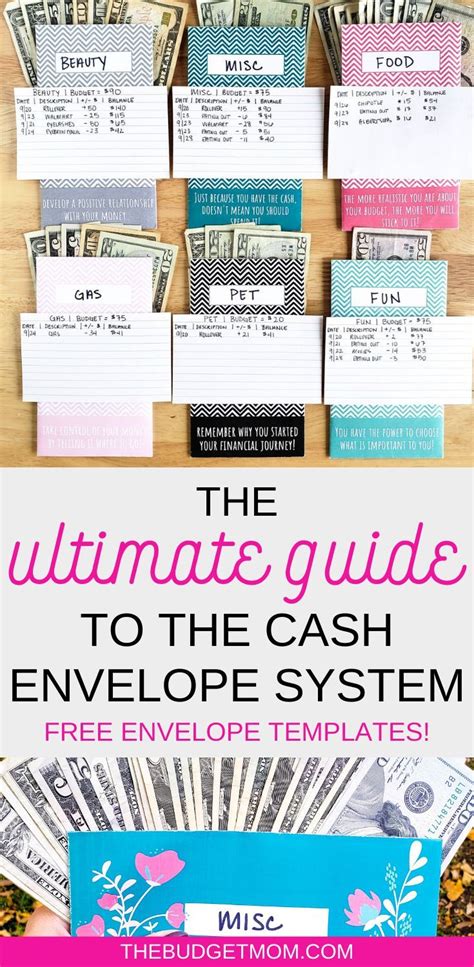

Label and Organize Your Envelopes

Each envelope should be clearly labeled with the name of the budget category and the amount of cash you have for that category. You can use physical envelopes, or if you prefer a digital method, many budgeting apps allow you to create virtual envelopes. The goal is to make it visually easy to see how much you have left in each category at any given time.

Action Steps:

- Label each envelope: Write the category name and the budgeted amount on the outside of each envelope.

- Keep envelopes accessible: Store them in your wallet, purse, or a dedicated budgeting folder so you can access them easily when you’re out shopping.

- Track spending: As you use cash, keep track of how much you’ve spent in each category. When you run out of cash in an envelope, you stop spending in that category until the next budgeting period.

Spend Only from the Envelopes

Once your envelopes are set up, the key to success is sticking to the system. When you make purchases, pay only with cash from the designated envelope for that category. For example, if you’re at the grocery store, you’ll pay with the cash from your "Groceries" envelope. If you’re going out for dinner, you’ll use the money in your "Dining Out" envelope.

Action Steps:

- Avoid using credit or debit cards: Using cards can lead to overspending. The physical act of paying with cash makes you more conscious of your spending.

- Monitor your progress: Keep an eye on how much money is left in each envelope, and adjust your spending accordingly. If you’ve run out of cash in one category but have money left in another, be mindful of how you move funds, as the goal is to stick to your initial limits.

Stay Disciplined and Track Your Progress

The cash envelope system requires discipline. The structure it provides will help curb impulse spending and help you stick to your financial goals. However, there will be times when you’re tempted to dip into other categories or “borrow” from next month’s funds. Staying disciplined is crucial.

Action Steps:

- Re-evaluate your budget: If you consistently run out of cash in a category (e.g., groceries or gas), you may need to adjust your budget for the next month.

- Celebrate successes: If you’re able to stick to your budget and save money in certain categories, celebrate those small wins! Use your savings to build an emergency fund or put towards a specific financial goal.

- Review monthly: At the end of each month (or your budget period), evaluate what worked and what didn’t. Adjust your spending categories as necessary.

Consider Digital Cash Envelope Systems

If carrying around cash isn’t practical for you, consider using digital envelope systems. There are various apps and tools that replicate the cash envelope method without requiring you to carry physical cash. Popular apps for this include:

- GoodBudget: This app allows you to create virtual envelopes and track your spending by category.

- Mvelopes: A budgeting tool that divides your money into virtual envelopes and allows you to track your spending.

- You Need a Budget (YNAB): A popular budgeting app that offers envelope-style budgeting features and helps you manage cash flow.

These apps give you the structure of a cash envelope system while allowing for the convenience of digital payments.

Use the System to Build Savings

Once you’re comfortable with the cash envelope system and it’s helping you control your spending, you can also use it to build savings. Consider adding an envelope for savings or unexpected expenses and allocate a small percentage of your income into it each month. This can be a great way to save for emergencies or future goals while sticking to your budget.

Action Steps:

- Create a savings envelope: If you don’t already have one, create a savings envelope to put aside a percentage of your income for long-term goals.

- Use “leftover” cash: If you have cash left over in any category at the end of the month, consider moving it into your savings envelope instead of spending it.