How to Use the 50/30/20 Rule for Budgeting

When it comes to managing your finances, creating a budget can seem overwhelming, especially if you're not sure where to start. The 50/30/20 rule is a simple, straightforward framework designed to make budgeting easier and more intuitive. Whether you're trying to save for the future, pay off debt, or just get a better handle on your spending, the 50/30/20 rule can be a helpful tool to guide your financial decisions.

In this article, we'll break down what the 50/30/20 rule is, how to implement it, and why it's such an effective budgeting method.

What Is the 50/30/20 Rule?

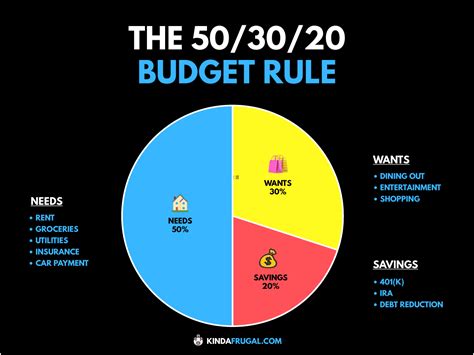

The 50/30/20 rule is a budget allocation method that divides your after-tax income into three main categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

The idea behind this rule is to create a balanced budget that allows you to cover your essential expenses, enjoy some discretionary spending, and still make progress on your financial goals, like saving for retirement or paying off high-interest debt.

Breaking Down the Categories

50% for Needs

The "Needs" category is for all the expenses you can't live without—basic necessities that are essential for your survival and daily life. This includes:

- Housing (rent or mortgage payments)

- Utilities (electricity, water, gas)

- Groceries

- Transportation (car payments, fuel, public transit)

- Insurance (health, auto, home)

- Minimum debt payments (credit card, student loans, etc.)

- Childcare or education costs

Anything that's crucial to your day-to-day life and well-being falls into this category.

30% for Wants

The "Wants" category is for everything else that isn't essential but adds value to your life or makes it more enjoyable. These are discretionary expenses that are flexible and can often be reduced or adjusted based on your financial goals. Examples include:

- Dining out (restaurants, takeout, coffee shops)

- Entertainment (movies, concerts, subscriptions like Netflix)

- Travel (vacations, flights, hotels)

- Hobbies (sports equipment, supplies, classes)

- Shopping (clothing, gadgets, home décor)

- Fitness memberships or activities (gym membership, yoga classes)

Wants are not necessities, so they are the first area to cut back on if you're facing a financial challenge or need to save more.

20% for Savings and Debt Repayment

The "Savings and Debt Repayment" category is where you allocate funds toward building your financial future. This includes:

- Emergency savings (for unexpected expenses like medical bills or car repairs)

- Retirement savings (contributions to 401(k), IRA, or other retirement accounts)

- Investment accounts (stocks, bonds, mutual funds)

- Debt repayment (paying off high-interest debt like credit cards or student loans)

The goal is to prioritize saving and reducing debt so you can build financial security and work towards your long-term financial goals.

How to Implement the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

The first thing you'll need is an accurate picture of your after-tax income. This is the money you take home after deductions like taxes, insurance premiums, and retirement contributions. If you're salaried, this is usually a simple monthly number, but if you're self-employed or have variable income, you'll need to average your monthly income.

For example, if your after-tax monthly income is $3,000, here's how the 50/30/20 rule would break down:

- 50% for Needs: $1,500

- 30% for Wants: $900

- 20% for Savings/Debt Repayment: $600

Step 2: Categorize Your Expenses

Next, you'll need to categorize your current expenses into the "Needs," "Wants," and "Savings/Debt Repayment" buckets. Track your spending for a month to see where your money is going. This can be done manually, or by using budgeting tools or apps like Mint, YNAB (You Need a Budget), or PocketGuard.

- Needs: Make sure you're only counting essential expenses. You may need to trim some costs (e.g., switching to a less expensive phone plan) to fit within the 50% allocation.

- Wants: This category is where you have the most flexibility. Start by analyzing which non-essential purchases can be cut back. For example, you could reduce dining out or cancel subscriptions you don’t use often.

- Savings/Debt Repayment: Ensure you're consistently putting at least 20% of your income into savings or toward paying off debt. If you're unable to reach this 20% target, it may mean adjusting your "Needs" or "Wants" categories.

Step 3: Adjust as Needed

The beauty of the 50/30/20 rule is that it's flexible. If you find you're spending more on "Wants" and less on "Savings" than you'd like, you can adjust by cutting back on discretionary spending. Likewise, if you're struggling to cover "Needs," you may need to reassess your housing or transportation costs.

Why the 50/30/20 Rule Works

The 50/30/20 rule offers several advantages that make it an appealing budgeting strategy:

-

Simplicity: One of the biggest barriers to budgeting is complexity. The 50/30/20 rule is easy to understand and doesn’t require extensive financial knowledge. It’s also flexible enough to fit most income levels and financial goals.

-

Balance: The rule ensures that you're not neglecting any area of your financial life—you're still covering your needs, allowing yourself some room for enjoyment, and making progress on your savings and debt.

-

Motivation: Allocating a set percentage of your income to savings and debt repayment can be motivating. It gives you clear financial goals to work toward and helps you prioritize your long-term financial health.

-

Realistic: The 50/30/20 rule acknowledges that budgeting isn’t about total deprivation. It gives you permission to enjoy life’s pleasures while still being financially responsible.

Tips for Success with the 50/30/20 Rule

- Track your spending: Even if you're using the 50/30/20 framework, it's crucial to monitor where your money is going. Use apps or spreadsheets to track your progress each month.

- Adjust for higher costs of living: If you live in an area with a high cost of living, you might find that your "Needs" category takes up more than 50%. In this case, it’s okay to shift the allocations slightly—just ensure you're still prioritizing savings and debt repayment.

- Start small: If you're new to budgeting or don't have much saved yet, you might not be able to hit the full 20% for savings and debt repayment right away. Start with a smaller percentage and gradually increase it as you reduce unnecessary spending.

- Reevaluate periodically: Your financial situation and goals will evolve over time. Revisit your budget regularly to ensure it reflects your current needs and priorities.