Is a Roth IRA Right for You? Pros and Cons Explained

When it comes to retirement planning, a Roth IRA (Individual Retirement Account) is often considered one of the best options available. However, like any financial tool, it’s not for everyone. Whether you’re just starting to save for retirement or looking to diversify your existing portfolio, understanding the pros and cons of a Roth IRA can help you decide if it's the right choice for your financial goals.

In this article, we’ll break down the key features of a Roth IRA, its benefits, and potential downsides, so you can make an informed decision about whether it aligns with your retirement strategy.

What is a Roth IRA?

A Roth IRA is a type of individual retirement account that allows your investments to grow tax-free. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t receive an immediate tax deduction. However, the big benefit is that qualified withdrawals in retirement are tax-free.

Here’s a quick summary of the key features of a Roth IRA:

- Contributions are made with after-tax dollars, meaning you don’t get an immediate tax break.

- Investment growth is tax-free.

- Withdrawals in retirement are tax-free, provided certain conditions are met.

- No required minimum distributions (RMDs) during your lifetime.

- Contribution limits apply, and there are income eligibility requirements.

Now, let’s dive into the pros and cons of a Roth IRA.

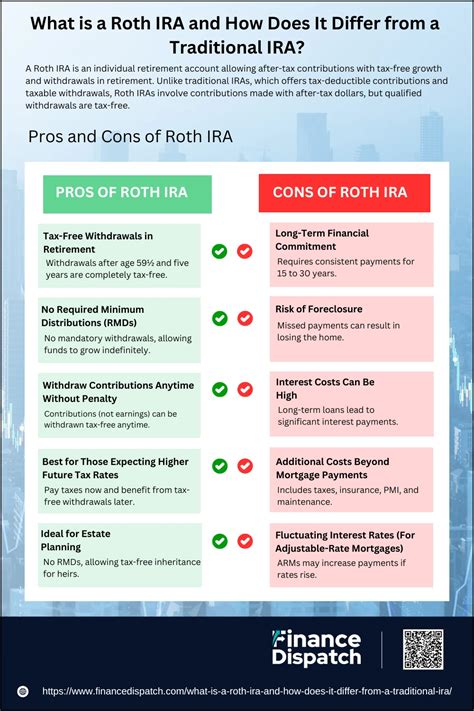

Pros of a Roth IRA

Tax-Free Withdrawals in Retirement

One of the biggest advantages of a Roth IRA is that qualified withdrawals in retirement are tax-free. This can be a huge benefit if you expect to be in a higher tax bracket when you retire. Since you pay taxes on your contributions upfront, you won’t owe any taxes on the money when you take it out in retirement, which can be a major advantage over traditional IRAs or 401(k)s, which are taxed at ordinary income rates upon withdrawal.

No Required Minimum Distributions (RMDs)

Unlike traditional IRAs and 401(k)s, which require you to start taking minimum distributions (RMDs) at age 73, a Roth IRA does not have any RMDs during your lifetime. This means you have more flexibility in how and when you withdraw your funds. You can let your money continue to grow tax-free for as long as you like, which is especially helpful if you don’t need to access your savings right away and want to maximize your investment growth.

Contributions Can Be Withdrawn Anytime, Tax-Free

Unlike other retirement accounts, where you may face penalties for early withdrawals, a Roth IRA allows you to withdraw your contributions (not earnings) at any time without penalties or taxes. This can be a great safety net if you need access to funds for an emergency or unplanned expense. However, keep in mind that withdrawing earnings before age 59½ can trigger taxes and penalties unless you meet certain conditions.

Potential for Higher Tax-Free Growth

Since you’re contributing to the Roth IRA with after-tax dollars, you’re essentially prepaying your tax bill for your future gains. As a result, if your investments perform well, your tax-free growth potential can be significant, especially for younger investors who have decades to let their investments compound.

Flexible Investment Choices

Roth IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and even real estate or alternative investments (if your account provider allows it). This flexibility allows you to customize your portfolio to match your risk tolerance, time horizon, and retirement goals.

Cons of a Roth IRA

Contribution Limits

One of the major downsides of a Roth IRA is that there are annual contribution limits. For 2024, the contribution limit is $6,500 per year, or $7,500 if you’re age 50 or older (known as the “catch-up” provision). This may not be enough for individuals who want to save larger amounts for retirement, especially if they’re later in their career or have higher retirement needs.

Income Limits for Eligibility

Roth IRAs have income limits for eligibility, meaning you can’t contribute if your income exceeds certain thresholds. For 2024, the income limits are as follows:

- Single filers: Income must be below $153,000 to contribute, with phase-out starting at $138,000.

- Married filing jointly: Income must be below $228,000 to contribute, with phase-out starting at $218,000.

If you exceed these income limits, you won’t be able to contribute directly to a Roth IRA. However, some high earners use a strategy called a “backdoor Roth IRA”, where they contribute to a traditional IRA and then convert the funds to a Roth IRA. This is a more advanced strategy and may involve additional tax considerations.

No Immediate Tax Deduction

Unlike traditional IRAs or 401(k)s, Roth IRA contributions are made with after-tax dollars, meaning you don’t get an immediate tax deduction. This can be a disadvantage if you’re in a high tax bracket now and want to lower your taxable income for the current year. In contrast, a traditional IRA or 401(k) can reduce your taxable income, potentially resulting in tax savings upfront.

Contribution Limits for High Earners

As mentioned, there are income limits that restrict high earners from contributing directly to a Roth IRA. While there are ways around this, such as the backdoor Roth IRA strategy, the process can be complex and may involve additional paperwork or taxes. Additionally, if your income fluctuates, it may be difficult to plan for consistent Roth IRA contributions.

Must Meet Specific Withdrawal Conditions

To take tax-free withdrawals of your investment earnings, you must meet certain conditions:

- You must be at least 59½ years old.

- You must have had the Roth IRA for at least 5 years.

If you take a withdrawal of earnings before meeting these requirements, you’ll owe taxes on the earnings and may incur a 10% penalty. While you can withdraw your contributions at any time without penalties, accessing earnings early can be costly.

Is a Roth IRA Right for You?

A Roth IRA is an excellent tool for individuals who expect to be in a higher tax bracket in retirement, want tax-free withdrawals, or need flexibility in how and when they access their funds. It’s also an ideal option for younger investors who have decades to allow their investments to grow tax-free. The ability to withdraw contributions at any time, without penalty, adds an element of flexibility that other retirement accounts don’t offer.

However, a Roth IRA may not be the best choice for everyone. If you’re in a high tax bracket now and would benefit from immediate tax deductions, a traditional IRA or 401(k) might be a better option. Similarly, if you exceed the income limits for a Roth IRA, you may need to consider alternative strategies like a backdoor Roth IRA.

Before deciding if a Roth IRA is right for you, consider your current and future tax situation, your retirement goals, and your investment timeline. If you’re unsure, it may be helpful to consult with a financial advisor who can help you navigate your options and choose the best retirement plan for your unique needs.