How to Plan for Big Expenses: Weddings, Vacations, and More

Life is full of milestones and moments that deserve to be celebrated, but many of these events—such as weddings, vacations, or buying a new home—can come with significant costs. While these expenses are often exciting, they can also be overwhelming if not planned for in advance. The key to managing these big expenses is to approach them strategically and methodically. With careful budgeting and smart saving, you can ensure that you’re financially prepared for life’s major events.

In this article, we’ll walk you through the steps to plan for big expenses like weddings, vacations, and other large life purchases, so you can enjoy these moments without financial stress.

Set a Clear Budget and Stick to It

The first step in planning for any big expense is to determine exactly how much you’re willing (or able) to spend. Setting a clear budget will give you a framework to work within and help you avoid overspending.

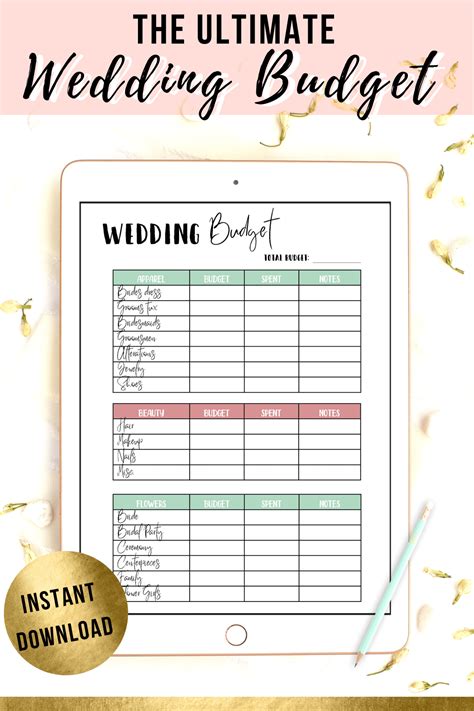

How to Create a Budget for Big Expenses:

- List out all anticipated costs: For weddings, this might include the venue, catering, photographer, and attire. For vacations, it could include flights, lodging, meals, and activities. For a home purchase, include the down payment, moving costs, and any furniture or home improvements.

- Research average costs: Understanding the typical costs associated with your big expense can help you set realistic expectations. For instance, the average cost of a wedding in the U.S. is around $30,000, while a weeklong vacation can range from $2,000 to $5,000 depending on the destination and type of travel.

- Include a contingency: It’s always a good idea to set aside extra funds (around 10-15%) for unexpected expenses that may arise during the planning process.

- Account for recurring costs: In some cases, big expenses aren’t one-time costs but involve ongoing payments. For example, if you’re buying a home, there are mortgage payments, property taxes, and maintenance costs to consider.

Once you have an accurate picture of the costs, decide how much you can comfortably afford to spend based on your income and savings.

Start Saving Early

The earlier you start saving for big expenses, the less financial pressure you’ll feel when the time comes. The key to saving for large expenses is to break them down into manageable amounts and save consistently.

How to Start Saving:

- Set up a dedicated savings account: Open a separate savings account for your specific goal (e.g., wedding, vacation, home). This makes it easier to track your progress and prevents you from accidentally spending the money on other things.

- Automate your savings: Set up automatic transfers from your checking account to your dedicated savings account. Treat these transfers as non-negotiable bills, and adjust the amounts as necessary based on your budget.

- Cut back on non-essential spending: Look for areas in your current budget where you can cut back to save for your goal. For example, you might reduce dining out, limit subscriptions, or delay purchasing new clothing or gadgets. The more you can save now, the less you’ll need to borrow or dip into credit when the time comes.

- Use windfalls and bonuses: When you receive a tax refund, work bonus, or any unexpected income, consider putting a portion (or all) of it into your savings account for the big expense. This can give your savings a substantial boost.

Research Financing Options (If Necessary)

In some cases, you may need to borrow money to cover the costs of your big expense, especially if your savings are not enough to fully fund it. When considering financing options, it’s crucial to choose one that fits your financial situation.

Common Financing Options:

- Personal loans: If you need to borrow money for a wedding or vacation, a personal loan may be an option. These loans typically have fixed interest rates and monthly payments, making it easier to budget.

- Credit cards: While credit cards offer flexibility, they also come with high interest rates if not paid off quickly. Use credit cards wisely, and avoid relying on them for large purchases unless you can pay off the balance within a few months.

- 0% interest promotional financing: Some credit cards or retailers offer 0% interest for a limited period. If you’re confident you can pay off the balance within the promotional period, this can be a cost-effective way to manage a big expense.

- Payment plans: Some vendors (such as wedding venues or vacation package companies) may offer payment plans that allow you to pay over time. While this can reduce upfront costs, be sure to check for hidden fees or interest charges.

Before taking on any debt, make sure to carefully assess your ability to repay it, and consider the long-term impact it may have on your financial health.

Plan for the Unexpected

Big expenses often come with unexpected costs or changes in plans. Whether it’s an unexpected surge in prices, last-minute cancellations, or unplanned purchases, these events can throw your budget off track. That’s why it’s important to plan for the unexpected.

How to Prepare for Unforeseen Costs:

- Emergency fund: Build an emergency fund specifically for your big expense. If you’re planning a wedding, for example, an emergency fund can cover last-minute changes or unforeseen vendor costs.

- Contingency planning: As mentioned earlier, include a contingency line in your budget (around 10-15% of the total cost). This gives you breathing room if things don’t go as planned.

- Get quotes and estimates: Whether you’re booking a vacation or hiring a wedding photographer, always get quotes and compare prices from different vendors. This helps ensure you don’t overpay for services and allows you to negotiate better deals.

Cut Costs Where Possible

Big expenses don’t always have to be extravagant. With a little creativity and flexibility, you can cut costs without compromising the quality of the experience.

Ways to Reduce Costs:

- Wedding: Consider getting married during off-peak months (typically winter or early spring), which can lower venue costs. You can also reduce your guest list, choose a smaller venue, or skip expensive extras like extravagant floral arrangements or costly favors.

- Vacation: Instead of an expensive international trip, consider a local vacation or off-season travel to reduce costs. Booking flights and accommodations early, using rewards points, and staying in vacation rentals can also help you save.

- Home purchase: If you’re buying a home, consider looking in more affordable neighborhoods, opting for a smaller home, or purchasing a fixer-upper and doing renovations over time.

Cutting costs doesn’t mean you have to sacrifice your dream event, but it can help you avoid unnecessary debt and make the experience more affordable.

Track Your Progress and Adjust When Necessary

Once you have a plan in place, it’s important to monitor your progress regularly. Track your savings and spending to ensure you’re on track to meet your goals. If you’re not saving as quickly as you’d like, look for areas where you can increase your savings or cut back further.

Tools for Tracking:

- Budgeting apps: Use budgeting apps like Mint, YNAB, or EveryDollar to monitor your spending and savings progress.

- Spreadsheets: If you prefer to track manually, a simple spreadsheet can help you stay organized and visually track your progress toward your savings goal.

If unexpected expenses arise or your goals change, be flexible and adjust your plan as needed. Life happens, and staying adaptable will help you reach your financial goals with less stress.

Celebrate and Enjoy the Moment

Once you’ve successfully planned and saved for your big expense, it’s time to enjoy the fruits of your hard work. Whether it’s walking down the aisle, taking your dream vacation, or moving into your new home, these moments are meant to be cherished.

By planning ahead, setting a budget, and saving consistently, you can enjoy your milestone moments without the burden of financial stress. You’ve worked hard to get to this point—now take the time to appreciate the experience and the journey.