How to Get Financially Organized for the New Year

The start of a new year is the perfect opportunity to hit the reset button on your financial life. Whether you’re hoping to save more, eliminate debt, or simply get a better handle on your spending, organizing your finances early in the year can set you up for long-term success. In this article, we’ll walk you through practical steps to help you get financially organized and start the year on the right track.

Review Your Current Financial Situation

Before you can move forward with your financial goals, it's essential to take stock of where you stand. This includes:

-

Net Worth: Calculate your assets (bank accounts, retirement savings, property) and liabilities (credit card debt, loans, mortgages). Subtract your liabilities from your assets to determine your net worth. This gives you a snapshot of your financial health.

-

Income vs. Expenses: Review your income sources and compare them to your monthly expenses. Are you living within your means, or is your spending outpacing your income?

-

Credit Score: Check your credit report and score to see if there are any issues that need addressing, like late payments or high debt utilization.

Action Step: Use a budgeting tool or app like Mint, YNAB (You Need a Budget), or a simple spreadsheet to track your income and expenses. This will give you a clear picture of your finances.

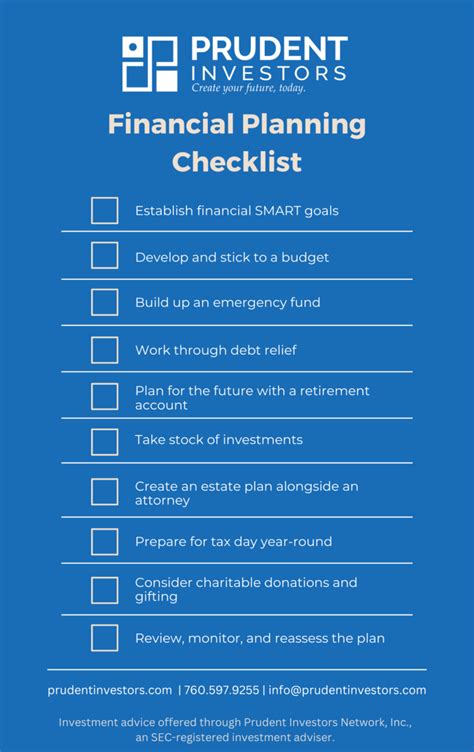

Set Financial Goals for the Year

With a fresh financial outlook, it’s time to set your goals. Your goals will help you stay focused and motivated throughout the year. Here are some common financial goals:

-

Save for an Emergency Fund: Financial experts recommend saving at least 3-6 months' worth of living expenses in an easily accessible emergency fund.

-

Pay Down Debt: If you have credit card debt, student loans, or a mortgage, prioritize paying them off. Consider using the debt snowball method (paying off the smallest debts first) or the debt avalanche method (tackling high-interest debts first).

-

Invest for Retirement: Contribute to retirement accounts like a 401(k), IRA, or Roth IRA to ensure you’re preparing for the future.

-

Save for Big Purchases: This could include a vacation, a down payment on a house, a new car, or other long-term savings goals.

Action Step: Write down your financial goals and break them into actionable, measurable steps. Make sure they are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Create or Revise Your Budget

A well-thought-out budget is the foundation of financial organization. It ensures that you’re allocating enough money to meet your goals while avoiding overspending. Here are some tips to create a solid budget:

-

Track Spending: Record every expense, from monthly bills to discretionary purchases like dining out and entertainment. This helps you understand where your money is going.

-

Use the 50/30/20 Rule: One common budgeting method is the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

-

Automate Savings: Set up automatic transfers to your savings account or retirement fund. This ensures that you pay yourself first before spending on discretionary items.

Action Step: Review your past spending patterns and create a new budget based on realistic goals for saving and living within your means. Consider using budgeting tools or apps to simplify this process.

Plan for Taxes

The new year is a great time to get ahead of tax season by planning for any upcoming taxes you might owe. Whether you're an employee or a freelancer, here are a few tips:

-

Organize Your Documents: Gather all relevant tax documents, such as W-2s, 1099s, and receipts for deductible expenses. Organize them by category to make filing easier.

-

Contribute to Retirement Accounts: Contributions to retirement accounts like IRAs and 401(k)s can reduce your taxable income, so consider maxing out contributions before the tax deadline.

-

Review Tax Deductions: If you’re eligible for tax deductions, such as home office expenses or student loan interest, make sure to account for them when filing.

Action Step: If possible, schedule an appointment with a tax professional early in the year to discuss strategies for minimizing your tax liability.

Automate Bill Payments and Subscriptions

One of the simplest ways to stay financially organized is to automate your bill payments. This ensures that you never miss a due date, preventing late fees and improving your credit score. Here’s how to streamline your payments:

-

Set Up Auto-Pay for Fixed Bills: Automate your rent/mortgage, utility bills, and insurance premiums. Just make sure your bank account has enough funds to cover these automatic withdrawals.

-

Review Recurring Subscriptions: Take a close look at all your recurring subscriptions (streaming services, gym memberships, etc.). Cancel any that you no longer use or need.

Action Step: Set reminders to review your subscriptions and ensure that all bill payments are set to auto-pay for the year.

Build Your Emergency Fund

An emergency fund is one of the most important financial tools for protecting yourself from unexpected costs. If you don’t already have an emergency fund, make it a priority to start one in the new year.

-

Set a Target: Aim for at least 3-6 months of living expenses, depending on your job stability and lifestyle.

-

Automate Contributions: Treat your emergency fund as a regular expense and set up automatic transfers into a high-yield savings account.

Action Step: Start with a small, achievable goal (e.g., $500 in the first quarter) and gradually build from there.

Review and Adjust Your Insurance Coverage

The new year is a good time to reassess your insurance needs to make sure you're adequately covered without overpaying. Review the following:

-

Health Insurance: Make sure your health insurance plan still meets your needs. If necessary, explore other options during open enrollment periods.

-

Life Insurance: If your family’s circumstances have changed (e.g., marriage, children), adjust your life insurance policy accordingly.

-

Auto and Home Insurance: Shop around for the best rates and consider increasing your deductibles if it makes sense for your financial situation.

Action Step: Conduct an annual insurance review and update your policies as needed.

Start Investing or Review Your Investments

Investing is an important way to build wealth over time. If you haven’t already started, consider getting started with low-cost index funds, mutual funds, or retirement accounts.

-

Review Your Portfolio: If you already invest, check the performance of your current investments. Are they aligned with your goals? Rebalance your portfolio if necessary to ensure it reflects your risk tolerance and objectives.

-

Max Out Retirement Contributions: If possible, increase your contributions to retirement accounts like a 401(k) or IRA to take full advantage of tax benefits.

Action Step: If you're new to investing, consider speaking with a financial advisor to create a strategy that works for you.