How to Teach Your Kids About Money and Financial Responsibility

Teaching your kids about money and financial responsibility is one of the most valuable gifts you can give them. Financial literacy is a crucial life skill that will serve them well as they grow into adulthood. From understanding the basics of saving and budgeting to developing the discipline needed to make smart financial choices, kids who learn these lessons early are better equipped to manage their money and avoid financial pitfalls later in life.

In this article, we’ll explore practical ways to teach your kids about money, financial responsibility, and the importance of making informed decisions. Whether your child is a toddler just starting to understand the concept of money or a teenager ready to manage their own budget, these tips will help you instill good financial habits that last a lifetime.

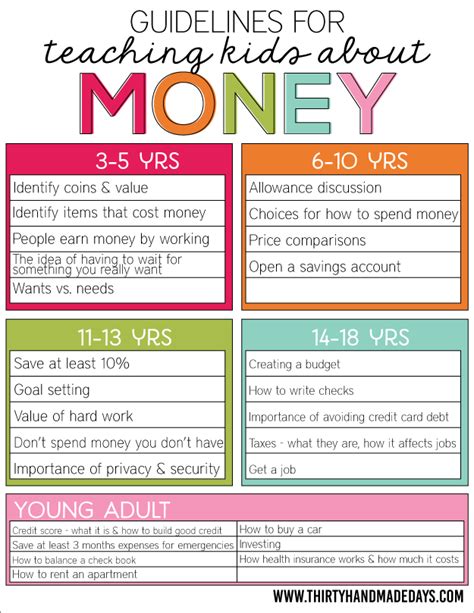

Start Early: Introduce Money Concepts at a Young Age

It's never too early to begin teaching kids about money. While younger children may not understand complex financial concepts, they can start grasping the basics of how money works.

Simple Activities for Young Kids:

- Play with play money: Use toys or play money to teach your child the value of coins and bills. This can help them understand the difference between a penny, nickel, dime, quarter, and dollar.

- Teach the concept of exchange: Show them how money is exchanged for goods and services by giving them small tasks around the house (like cleaning their room) in exchange for a few dollars or coins.

- Use jars for saving: Start with a simple system of three jars—one for saving, one for spending, and one for sharing (charity). Whenever your child receives money, such as an allowance or gift, have them divide it among the jars. This teaches them the basics of budgeting, saving, and charitable giving.

The earlier you start, the easier it will be for your child to develop positive habits around money.

Give Them a Budget (and Let Them Make Mistakes)

As your child gets older, one of the best ways to teach them about financial responsibility is by giving them a budget to manage. This could start with an allowance or a small amount of money for specific purposes (like personal expenses or fun activities).

Steps to Creating a Kid's Budget:

- Decide on the amount: Give your child an allowance based on their age and responsibilities. For younger kids, this might be a weekly allowance, while older kids can receive more autonomy with their spending.

- Set spending limits: Help them understand how to divide their money. Encourage them to prioritize needs over wants and make choices about how much to save, spend, or give to charity.

- Teach goal setting: Help them set goals for things they want to buy or save for. Whether it's a new toy, a video game, or something more significant like a bike, saving for a goal teaches kids the value of delayed gratification.

Let your child make mistakes within their budget. If they spend all their money on something they don’t need and don’t have enough for other items, they will learn an important lesson about prioritizing and planning. These experiences can be great teaching moments!

Use Real-Life Experiences to Teach About Money

Incorporate lessons about money into everyday situations. Whether you’re at the grocery store, paying bills, or planning a family vacation, there are countless opportunities to talk to your kids about money and financial decision-making.

Everyday Learning Opportunities:

- Grocery Shopping: Take your child to the grocery store and give them a budget for certain items. Teach them how to compare prices, look for sales, and make decisions about what is worth buying.

- Paying Bills: Show them how you pay your bills and explain the basics of monthly expenses—mortgage, utilities, insurance, etc. Help them understand the importance of paying bills on time and how it impacts your family’s financial health.

- Planning for Big Purchases: Involve your kids in planning for larger purchases, such as a family vacation or buying a new car. Show them how to set a savings goal, create a plan to reach it, and consider trade-offs in the process.

By making money discussions a regular part of your daily life, you help your kids see how important financial decisions are in every aspect of life.

Teach the Difference Between Needs and Wants

One of the most important financial lessons your child can learn is the difference between needs and wants. Understanding this distinction will help them make better spending decisions as they get older.

How to Teach the Difference:

- Use examples: Explain that needs are things essential for survival, such as food, clothing, and shelter, while wants are items that aren’t necessary but are nice to have (like toys, gadgets, or designer clothes).

- Incorporate it into daily choices: When your child expresses a desire for something, ask them to consider whether it's a need or a want. This can help them develop a more mindful approach to spending.

- Give them decision-making power: Allow your kids to make decisions about how to spend their allowance or savings, and encourage them to think about whether their purchase is a need or a want.

Teaching this concept early helps kids understand that responsible money management is about prioritizing essential needs and balancing discretionary spending.

Introduce Saving and Investing

As your child grows, it's important to teach them the value of saving and investing. This can help set them on the path to financial independence and build wealth over time.

Teaching Kids About Saving:

- Set up a savings account: Once your child is old enough (around 10-12), open a savings account for them. Help them deposit their allowance or money gifts into the account regularly, and track their savings growth with interest.

- Discuss the power of compound interest: Teach your child the concept of earning interest on their savings and how it allows money to grow over time. You can use a simple online calculator to demonstrate how small amounts saved can grow with interest.

Introducing Investing:

- Start with stocks: Introduce your kids to the stock market by helping them invest a small amount of money in stocks or mutual funds. Explain how stocks can go up and down in value but offer the potential for long-term growth.

- Use apps for learning: There are many child-friendly investment apps, such as Stockpile or Greenlight, that allow kids to invest real money in fractional shares of stocks with supervision.

By teaching your kids about saving and investing, you help them understand the importance of growing their wealth over time rather than relying solely on earned income.

Discuss Debt and Credit Responsibility

As kids approach their teenage years, it’s essential to start discussing the concepts of debt and credit. Understanding how borrowing works—and the consequences of mismanaging debt—can help them avoid financial mistakes as they enter adulthood.

Teaching Kids About Debt:

- Explain borrowing and interest: Teach your kids about credit cards, loans, and interest rates. Use real-life examples, such as borrowing money to buy a bike or paying for things with a credit card.

- Discuss the dangers of debt: Help them understand how debt can spiral out of control if it’s not managed responsibly. Explain the importance of paying bills on time and avoiding high-interest debt, like credit cards.

You can even begin with simple conversations about the importance of using credit wisely and paying off balances in full to avoid interest charges.

Model Good Financial Habits

Your kids are always watching, and they learn a lot from observing how you handle money. Set a good example by demonstrating healthy financial habits.

Ways to Model Financial Responsibility:

- Be mindful of your spending: Show your kids that you carefully consider purchases, live within your means, and prioritize saving for the future.

- Discuss financial decisions: When appropriate, talk with your kids about the decisions you make related to money. This can include explaining why you choose to save rather than spend, or why you’re making a big purchase decision.

- Maintain a balanced attitude: Avoid displaying anxiety about money or making negative remarks about finances. Instead, approach money discussions with a calm, balanced mindset to set a healthy tone for your child’s relationship with money.

By modeling financial responsibility, you give your kids a living example of how to manage money effectively.