How to Balance Saving for Retirement with Paying Off Debt

Managing personal finances can often feel like juggling multiple priorities. For many people, the two major financial goals that require attention are saving for retirement and paying off debt. Both are crucial to securing long-term financial health, but it can be challenging to balance these competing priorities, especially when debt feels overwhelming. Should you prioritize paying down high-interest credit cards or invest in a retirement fund? Should you delay saving for the future to pay off loans faster? Finding a middle ground is key to achieving both financial goals without sacrificing one for the other.

In this article, we’ll explore strategies to effectively balance saving for retirement while managing debt, ensuring that you make progress on both fronts.

Understand the Types of Debt You Have

Not all debt is created equal, and understanding the types of debt you owe can help you decide where to allocate your money most effectively. Debt generally falls into two categories:

- High-interest debt: This includes credit cards, payday loans, and certain personal loans. These debts often have interest rates that can exceed 20% or more, which makes them costly to carry.

- Low-interest debt: This category includes mortgages, student loans, and some auto loans. Interest rates for these debts tend to be lower, especially if they are secured loans.

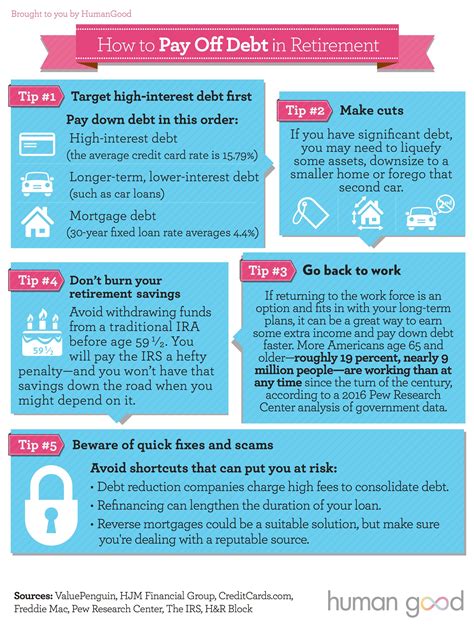

If you're balancing both types of debt, your immediate focus should be on high-interest debt first. This is because the interest on this type of debt compounds quickly, potentially costing you more in the long run.

Prioritize High-Interest Debt

Paying off high-interest debt should be a priority for several reasons:

- Cost savings: High-interest debt accumulates more interest over time, meaning you end up paying much more than you originally borrowed. By tackling it first, you reduce the total amount you owe.

- Credit score impact: High-interest debt (like credit cards) can negatively impact your credit score if you carry a balance. Paying it off helps improve your credit utilization ratio and, in turn, your credit score.

Once you’ve paid off high-interest debt, you’ll have more flexibility to allocate funds to retirement savings and other financial goals.

Debt snowball vs. debt avalanche method:

- The debt snowball method focuses on paying off the smallest debt first and moving up to larger debts. This can provide quick wins and motivation.

- The debt avalanche method, on the other hand, prioritizes paying off debts with the highest interest rate first. This method is often the most financially efficient, as it minimizes the amount of interest you pay over time.

Choose the strategy that best aligns with your financial habits and goals.

Start Saving for Retirement Early, Even in Small Amounts

While paying off debt should be a priority, don’t completely neglect retirement savings. The earlier you start saving, the more time your investments have to grow. Even small contributions can accumulate over time thanks to the power of compound interest.

- Employer-sponsored retirement plans: If your employer offers a 401(k) or similar retirement plan with a match, aim to contribute at least enough to receive the full match. This is essentially "free money" and should be prioritized before paying extra toward debt.

- Individual Retirement Accounts (IRAs): If you don’t have access to an employer plan, consider opening an IRA. Both Traditional IRAs and Roth IRAs offer tax advantages, and you can contribute up to a certain limit each year.

Even if you can’t contribute a lot right now, getting started with retirement savings ensures that you’re building a financial cushion for the future.

Create a Budget and Track Your Spending

Balancing debt repayment and retirement savings requires a disciplined approach to budgeting. Creating a budget helps you allocate your income efficiently, ensuring that you're meeting both your current obligations and your future needs.

- Track expenses: Make a list of all your monthly expenses, including debt payments, utilities, groceries, and entertainment. Look for areas where you can cut back.

- Set savings goals: Define how much you want to save for retirement each month. This amount may be small at first but should increase as you pay down high-interest debt.

- Automate payments: Set up automatic transfers to both your debt accounts and retirement savings accounts. Automation helps you stay consistent and prevents you from accidentally overspending.

A budget keeps you accountable and ensures you make progress on both debt repayment and retirement savings.

Consider Refinancing or Consolidating Debt

If you have high-interest debt, consider options like refinancing or debt consolidation. These methods can help reduce the interest rate you’re paying, allowing you to free up more money for retirement contributions.

- Refinancing: If you have a loan (like a student loan or mortgage) with a high-interest rate, refinancing could help you lower the rate and monthly payment. This could provide you with additional funds to put toward retirement savings.

- Debt consolidation: This involves combining multiple debts into a single loan, often at a lower interest rate. It can simplify your payments and potentially reduce the amount of interest you pay, making it easier to manage your finances.

Refinancing and consolidation should be done carefully and in consultation with a financial advisor to ensure that they align with your long-term financial goals.

Increase Your Income

If your current income isn’t enough to allow you to comfortably pay off debt and save for retirement, consider ways to increase your earning potential.

- Side hustles: Freelancing, tutoring, consulting, or driving for a rideshare service are ways to make extra money that can go toward both debt repayment and retirement savings.

- Ask for a raise: If you’ve been in your current job for a while and your performance is strong, consider asking for a salary increase. Even a small raise can make a significant difference in your ability to save for retirement.

Increasing your income will help you reduce debt more quickly while still contributing to your future savings.

Revisit Your Goals Regularly

Life circumstances change, and so do your financial priorities. It's important to regularly revisit your financial goals to ensure you’re on track. This might include adjusting your debt repayment strategy, contributing more to retirement savings as you pay off debt, or reevaluating your budget to account for any changes in income or expenses.