How to Track Your Expenses Like a Pro

Managing your finances isn’t just about earning more money; it’s about knowing where your money goes and making sure it’s working for you. One of the most essential skills for financial success is tracking your expenses effectively. Whether you're saving for a big purchase, trying to pay off debt, or building an emergency fund, understanding your spending habits is crucial.

If you’ve struggled with staying on top of your expenses or simply want to improve your financial management skills, don’t worry. In this article, we’ll walk you through how to track your expenses like a pro and provide practical tips and tools to help you stay on budget and achieve your financial goals.

Start by Categorizing Your Expenses

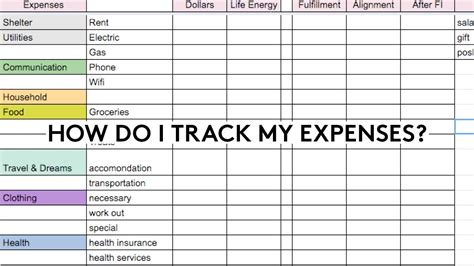

The first step in tracking your expenses is to break them down into categories. This helps you get a clear picture of where your money is going. Common expense categories include:

- Fixed Expenses: These are regular monthly payments that stay the same, such as rent, mortgage, utilities, insurance, and subscriptions (e.g., Netflix, gym memberships).

- Variable Expenses: These can fluctuate from month to month, such as groceries, dining out, transportation (gas, public transit), and entertainment.

- Debt Payments: Any loans or credit card payments should also be tracked as they impact your cash flow.

- Savings and Investments: Money that goes toward your savings, retirement accounts, or investments.

- Discretionary Spending: These are non-essential expenses, like shopping, hobbies, or travel.

Pro Tip: Use a spreadsheet or budgeting app to create categories that make sense for your lifestyle. Having clear categories helps you identify areas where you might overspend or where you could cut back.

Choose the Right Expense Tracking Method

There are several ways to track your expenses. The best method for you will depend on your financial goals, preferences, and how hands-on you want to be. Below are some of the most effective ways to track your expenses:

a. Manual Tracking with Pen and Paper

This is the most old-school method, but it can still work for those who enjoy the process of writing things down. You’ll need to keep receipts and manually record every transaction. While it requires more effort, it can also help you become more aware of your spending habits.

How to Do It:

- Carry a small notebook or planner with you.

- Write down every purchase as soon as it’s made.

- At the end of the day or week, review your spending and categorize it.

b. Spreadsheets

Spreadsheets like Google Sheets or Microsoft Excel can be a great middle ground. You can create custom templates that track your income, expenses, and savings. Spreadsheets give you flexibility and can be updated easily, but you’ll still need to input your data manually.

How to Do It:

- Create a simple spreadsheet with columns for date, expense category, description, and amount.

- Set up formulas to automatically sum your expenses for each category and total your monthly spending.

- Regularly update your sheet with new purchases.

c. Budgeting Apps

If you want a more automated way to track your expenses, consider using a budgeting app. Apps like Mint, YNAB (You Need A Budget), or PocketGuard sync with your bank accounts and credit cards to automatically track your spending. These apps can categorize expenses for you and provide helpful visualizations, such as pie charts or spending reports.

How to Do It:

- Link your bank and credit card accounts to the app.

- Review the app’s monthly summary to see where your money went and which categories you’re overspending in.

- Set up alerts and budgets for each category to stay on track.

d. Expense Tracking Software

For those with more complex financial situations, or if you run a business, using expense tracking software like Expensify or QuickBooks might be beneficial. These platforms allow you to manage both personal and business expenses and can integrate with other financial tools.

Monitor Your Spending Regularly

Tracking expenses once a month won’t do much good if you’re not regularly monitoring your spending. To stay on top of your finances, review your expenses at least once a week. This allows you to identify any red flags early and make adjustments before the end of the month.

Pro Tip: Set a weekly reminder to check your expenses. The more often you review, the more aware you’ll be of your spending habits and potential overspending.

Set a Budget and Stick to It

Tracking your expenses is only effective if you have a clear budget in place. Once you have a breakdown of your expenses, set realistic limits for each category and stick to them. A budget ensures that you are intentionally allocating your money towards your priorities, whether that’s savings, debt repayment, or discretionary spending.

How to Create a Budget:

- Determine Your Income: Calculate how much money you have coming in each month (after taxes).

- List Fixed and Variable Expenses: Include all your monthly bills (rent, utilities, subscriptions) and estimate costs for variable expenses (groceries, entertainment).

- Allocate Funds for Savings: Aim to put aside at least 20% of your income for savings and investments.

- Review and Adjust: Regularly review your budget and make adjustments if necessary. If you overspend in one category, reduce the spending in another to stay on track.

Pro Tip: Use the 50/30/20 rule as a simple budgeting guideline: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

Analyze Your Spending and Identify Patterns

After tracking your expenses for a while, take time to analyze your spending patterns. Are you spending more on dining out than you’d like? Are there subscriptions you’re no longer using but still paying for? Analyzing your expenses can help you identify areas where you can cut back and save money.

How to Analyze Your Spending:

- Use apps that generate visual reports, such as pie charts or bar graphs, to make the analysis easier.

- Review your expense categories and look for trends. Are there categories that consistently exceed your budget?

- Consider whether there are recurring expenses that you can reduce or eliminate, such as canceling unused subscriptions or downgrading services.

Use Expense Tracking to Plan for the Future

Tracking expenses isn’t just about managing day-to-day finances; it’s about planning for the future. By understanding where your money is going, you can set more realistic financial goals. This could be saving for a vacation, paying off debt, or building an emergency fund.

How to Use Your Tracking Data for Future Planning:

- Set Financial Goals: Use your spending data to set goals that are in line with your current income and expenses. For example, if you see that you’re overspending on non-essential items, you can set a goal to reduce that spending and allocate more to your savings.

- Track Progress: Monitor your progress toward your financial goals each month. As you track your expenses, ensure that you’re sticking to your budget and adjusting your behavior when needed.

- Plan for Large Expenses: If you know you have a big expense coming up (like a vacation or home renovation), use your tracking data to prepare in advance by saving money or adjusting your budget.