How to Save for College Without Going Into Debt

The rising cost of college tuition has made it more important than ever for students and parents to plan ahead when it comes to funding higher education. In fact, the average student loan debt in the U.S. has reached a staggering $30,000 per borrower, making it clear that avoiding debt is a priority for many families. While saving for college may seem like a daunting task, there are strategies that can help you fund education without relying on loans.

Whether you’re a parent trying to save for your child’s future or a student looking for ways to manage your college expenses, here are practical steps you can take to save for college and avoid accumulating debt.

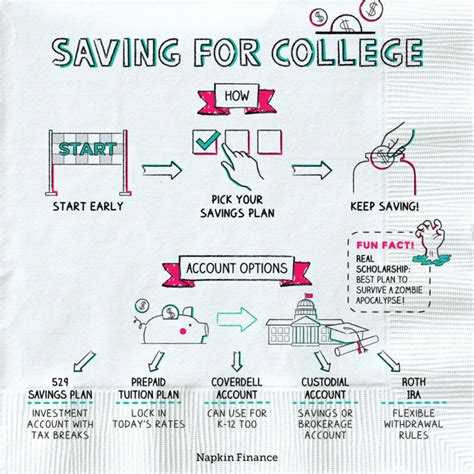

Start Saving Early

The earlier you begin saving for college, the better. Time is a powerful tool when it comes to saving money, thanks to the benefits of compound interest. The earlier you start, the more time your money has to grow.

How to Start Early:

- Set a goal: Estimate how much college will cost when the time comes. Take into account tuition, fees, books, housing, and other expenses. Use a college savings calculator to get a rough estimate of what you’ll need.

- Open a dedicated savings account: Use a savings account, such as a 529 College Savings Plan, that offers tax advantages and is specifically designed for education savings. With a 529 plan, the money you contribute grows tax-free, and withdrawals are also tax-free when used for qualified educational expenses.

Pro Tip: Even if you can only save a small amount each month, starting early will give you the benefit of compounding over time, making it easier to reach your savings goal.

Take Advantage of 529 College Savings Plans

A 529 Plan is one of the best tools available for saving for college, thanks to its tax benefits. The contributions grow tax-free, and when used for qualified expenses such as tuition, fees, books, and even room and board, withdrawals are also tax-free.

How 529 Plans Work:

- Tax Advantages: Contributions to a 529 plan are not tax-deductible at the federal level, but many states offer tax breaks for residents. The money grows without being taxed, and you won’t owe taxes on the money when you withdraw it for education-related expenses.

- Flexibility: You can use the funds at eligible colleges, universities, and trade schools across the U.S. and abroad. Additionally, if the beneficiary doesn’t use the funds, you can change the beneficiary to another family member.

Pro Tip: If your state offers a state tax deduction for contributions to a 529 plan, be sure to take advantage of it. This can lower your taxable income and give you an additional benefit while saving for college.

Set Up Automatic Contributions

One of the best ways to save consistently is to set up automatic contributions. Setting up automatic monthly transfers into a savings account or 529 plan ensures that saving for college becomes a regular habit. It’s also a great way to prevent the temptation of spending the money on other things.

How to Automate Your Savings:

- Choose a percentage: Decide on a set percentage or amount of your monthly income to allocate toward your college fund. Even small amounts add up over time.

- Automate the process: Set up automatic transfers from your checking account to your college savings account. If you’re using a 529 plan, most plans allow you to set up recurring deposits.

Pro Tip: If your employer offers a direct deposit option, you can have a portion of your paycheck directly deposited into a savings or 529 plan. This “pay yourself first” strategy ensures that saving for college is a priority.

Consider a Custodial Account for Minors

If you’re saving for a child’s education, you may want to explore a custodial account, also known as a UGMA/UTMA account. These accounts allow you to save money on behalf of a minor, and the child gains control of the account once they reach the age of majority in your state (typically 18 or 21).

How Custodial Accounts Work:

- Flexible use: While custodial accounts don’t offer the same tax advantages as a 529 plan, they can be used for anything the child needs, including college expenses.

- Ownership: The child gains ownership of the account once they reach adulthood, which can be a disadvantage if you’re concerned about how the funds will be used. However, the account can still be a helpful tool for saving.

Pro Tip: If you want the funds to be used exclusively for education, it may be better to stick with a 529 plan. Custodial accounts allow more flexibility, but they don’t provide the same tax benefits or restrictions on withdrawals.

Use Scholarships and Grants

Scholarships and grants are a great way to reduce the need for student loans. Unlike loans, scholarships and grants don’t need to be repaid. There are many different types available, from those based on academic merit to those based on financial need, extracurricular involvement, or even specific career paths.

How to Find Scholarships and Grants:

- Start early: Research scholarships and grants as soon as possible, and start applying during your junior or senior year of high school. Many scholarships have deadlines well in advance of the school year.

- Use scholarship search engines: Websites like Fastweb, Scholarships.com, and Niche offer search tools to help you find opportunities based on your background and interests.

- Look locally: Many local organizations, such as businesses, foundations, or community groups, offer scholarships to residents or employees.

Pro Tip: Apply to as many scholarships as possible. Even smaller awards can add up over time and help reduce your overall college expenses.

Find Affordable College Options

Not all colleges are equally expensive, and there are many ways to save on tuition while still receiving a quality education. Whether you’re exploring public universities, community colleges, or trade schools, there are options that can help you save money without sacrificing education quality.

How to Choose an Affordable College:

- Start at a community college: If you’re open to it, starting at a community college for the first two years can significantly reduce your overall tuition costs. After completing general education courses, you can transfer to a four-year university to finish your degree.

- Consider in-state schools: Public colleges and universities often offer lower tuition rates for in-state students. Check the residency requirements to see if you qualify.

- Look for colleges with strong financial aid: Some colleges have generous financial aid programs, including merit-based scholarships, grants, and work-study opportunities.

Pro Tip: Consider living at home or opting for shared housing to cut down on room and board costs. Every bit of savings can make a difference.

Part-Time Work and Work-Study Programs

If you’re in high school or already in college, taking on a part-time job or applying for a work-study program can help you save for tuition and other expenses. Many colleges offer work-study programs that allow students to work on campus in exchange for financial aid.

How to Use Part-Time Work:

- Find flexible jobs: Look for jobs that align with your class schedule, such as tutoring, working in a campus library, or assisting in a professor’s research.

- Save your earnings: Set aside your earnings specifically for education-related expenses, like books, fees, or future tuition payments.