The Importance of Financial Literacy in Education

In today’s fast-paced and complex financial landscape, financial literacy has become a crucial life skill. Unfortunately, many individuals enter adulthood without a clear understanding of basic financial principles, leaving them ill-prepared for managing their personal finances, making informed decisions, or navigating the broader economic world. As a result, financial difficulties such as overwhelming debt, poor credit, and inadequate savings are common challenges faced by many.

To address these issues, there has been a growing emphasis on integrating financial literacy into education. Schools and universities, traditionally focused on academic subjects like math, science, and literature, are beginning to recognize the importance of teaching students how to manage money. This shift is essential for equipping future generations with the tools they need to make sound financial decisions, achieve long-term financial stability, and contribute to a healthier economy.

What is Financial Literacy?

Financial literacy refers to the ability to understand and effectively manage personal finances. It involves a wide range of skills and knowledge, including budgeting, saving, investing, managing debt, understanding credit, and preparing for retirement. Financially literate individuals are better positioned to handle unexpected expenses, plan for long-term goals, and avoid common financial pitfalls.

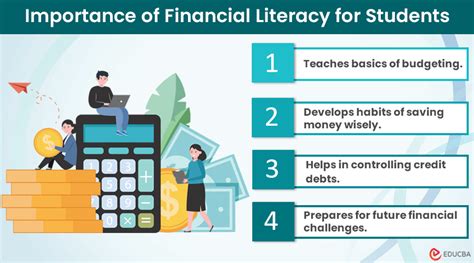

Incorporating financial literacy into education allows students to develop a foundational understanding of how money works and how to manage it responsibly.

The Role of Financial Literacy in Education

-

Empowering Students to Make Informed Decisions Financial literacy equips students with the knowledge to make informed decisions about their finances. Understanding the basics of budgeting, saving, and credit enables students to navigate their personal finances with confidence. This empowers them to make informed choices when they enter adulthood, whether it's deciding how to save for a major purchase, managing student loan debt, or investing in their future.

-

Reducing Financial Stress and Anxiety Financial stress is one of the leading causes of anxiety among adults. When individuals don’t have the skills to manage their money, they often feel overwhelmed by debt or financial instability. Introducing financial literacy early in education helps students gain a sense of control over their finances, reducing feelings of stress and uncertainty about the future.

-

Promoting Healthy Financial Habits The earlier students learn about financial management, the more likely they are to develop good habits that will benefit them throughout their lives. Teaching concepts like the importance of saving, living within one’s means, and understanding the impact of interest rates can lead to more responsible financial behavior as students become adults.

-

Supporting Economic Stability When individuals are financially literate, they are more likely to make sound financial decisions, which can have a positive ripple effect on the broader economy. People who are knowledgeable about financial planning are less likely to fall into debt traps, contribute to economic downturns, and are more likely to save and invest for the future. Collectively, this leads to a more stable, resilient economy.

-

Increasing Opportunities for Financial Independence Financial literacy can open doors to economic opportunities that students may not have otherwise considered. Knowledge of investments, savings accounts, and credit scores can encourage students to take advantage of opportunities such as investing in stocks, buying a home, or starting a business. When students are aware of the financial tools available to them, they are more likely to pursue paths that will lead to financial independence and security.

-

Fostering Long-Term Success Financial literacy is not just about managing money in the short term—it’s about planning for the future. Understanding the concepts of retirement planning, taxes, insurance, and estate planning can help students make long-term decisions that secure their financial future. The earlier students learn these skills, the more time they have to put them into practice, leading to greater financial security as they age.

The Global Shift Toward Financial Literacy in Education

Countries around the world are beginning to recognize the importance of financial literacy in education. In 2013, the Organisation for Economic Co-operation and Development (OECD) launched the International Network on Financial Education to help promote financial literacy across countries. Many nations, including the United States, the United Kingdom, Canada, and Australia, have introduced financial literacy courses and integrated them into national curriculums.

In the U.S., programs such as Jump$tart and National Endowment for Financial Education (NEFE) have been working to provide students with the resources and tools necessary to improve their financial knowledge. Meanwhile, some states have passed legislation requiring students to complete a financial literacy course before graduating from high school. These steps are helping to ensure that students have a solid foundation in managing money when they enter the workforce or pursue higher education.

Challenges to Implementing Financial Literacy in Schools

While the benefits of financial literacy in education are clear, there are several challenges to its widespread implementation.

-

Lack of Teacher Training

Many teachers may not feel equipped to teach financial literacy. Without proper training or resources, it can be difficult for educators to impart financial knowledge effectively. This is why it's essential for governments and school systems to provide teachers with the tools and professional development they need to teach these concepts. -

Curriculum Overload

Schools already have a packed curriculum, and adding financial literacy can sometimes be viewed as another burden. However, educators and policymakers must recognize that financial education is as important as other core subjects, as it directly impacts students' ability to succeed in the real world. -

Unequal Access to Resources

Not all schools have the same level of resources, and this disparity can affect the quality of financial education. Schools in low-income areas may not have access to up-to-date materials or professional development programs for teachers. Addressing these inequalities is crucial to ensure that all students, regardless of their background, have equal access to financial education.