How to Manage Your Finances and Live Debt-Free

Achieving financial freedom and living debt-free is a dream for many, but the path to get there requires discipline, planning, and a commitment to making smart financial decisions. While it may seem overwhelming at first, with the right strategies in place, managing your finances and becoming debt-free is entirely possible. In this article, we’ll explore practical steps to take control of your money, eliminate debt, and build a secure financial future.

Understand Your Current Financial Situation

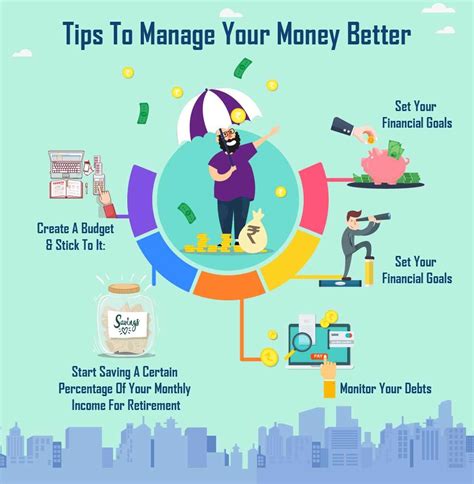

The first step in managing your finances is to gain a clear understanding of where you stand financially. This means assessing your income, expenses, debts, and savings. Here’s how you can get started:

-

Track Your Income and Expenses: Start by listing all of your sources of income and tracking every dollar you spend. Use tools like budgeting apps (e.g., Mint, YNAB) or even a simple spreadsheet to categorize your expenses and see where your money is going.

-

Evaluate Your Debts: List all your debts, including credit card balances, student loans, car loans, and mortgages. Include the interest rates and minimum monthly payments for each debt. This will give you a clear picture of how much you owe and where your focus should be.

-

Review Your Savings: Take note of any savings or investments you have, including retirement accounts, emergency funds, and other assets. This will help you set financial goals for the future.

Create a Realistic Budget

A budget is the foundation of sound financial management. It helps you allocate your income in a way that covers essential expenses while allowing you to save and pay off debt. To create a budget:

-

Use the 50/30/20 Rule: A common budgeting strategy is the 50/30/20 rule:

- 50% of your income should go toward needs (housing, utilities, groceries, transportation).

- 30% should go toward wants (entertainment, dining out, hobbies).

- 20% should be dedicated to savings and debt repayment.

-

Track and Adjust: Budgeting isn’t a one-time task. Continuously track your spending to ensure you stay on track and adjust when necessary. If you find that you’re spending more than you’d like in a certain category, consider making cuts.

Build an Emergency Fund

An emergency fund is a critical part of financial security. It’s designed to cover unexpected expenses, like medical bills, car repairs, or job loss, without relying on credit cards or loans.

-

Aim for 3 to 6 Months of Expenses: Ideally, your emergency fund should cover 3 to 6 months’ worth of living expenses. This cushion will help you avoid going into debt when emergencies arise.

-

Start Small: If building a large emergency fund feels daunting, start by setting aside a small amount each month. Gradually increase your savings until you reach your goal.

Eliminate High-Interest Debt

Debt, especially high-interest debt like credit card balances, can quickly spiral out of control if not managed properly. The key to becoming debt-free is to tackle these high-interest debts first.

-

Debt Snowball Method: Pay off your smallest debt first while making minimum payments on all other debts. Once the smallest debt is paid off, apply the amount you were paying on it to the next smallest debt, and so on. This method provides motivation as you see debts disappearing one by one.

-

Debt Avalanche Method: If you’re more focused on saving money on interest, the debt avalanche method may be more suitable. With this strategy, you focus on paying off the debt with the highest interest rate first, then move on to the next highest, and so on.

-

Negotiate Lower Interest Rates: Contact your creditors to negotiate lower interest rates. This can help you pay off debt faster and with less interest.

-

Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. Debt consolidation can simplify payments and lower the total interest you pay over time.

Avoid New Debt

While it’s essential to pay off existing debt, it’s just as important to avoid accumulating new debt. Here’s how you can stay debt-free:

-

Limit Credit Card Use: Use credit cards sparingly and always pay off your balance in full each month to avoid interest charges.

-

Live Below Your Means: Adopt a lifestyle that prioritizes saving and living within your means. Avoid overspending on non-essential items, and always question whether you truly need a purchase before making it.

-

Plan for Big Purchases: Instead of putting large expenses (like vacations, furniture, or electronics) on credit, save for them in advance. This ensures you don’t end up with more debt than you can handle.

Save for the Future

Becoming debt-free is only one part of financial health. It’s equally important to save and invest for your future.

-

Retirement Savings: Contribute to retirement accounts such as a 401(k), IRA, or Roth IRA. If your employer offers a match, try to contribute enough to take full advantage of the match.

-

Automate Savings: Set up automatic transfers to savings or investment accounts each month. This ensures that you save consistently, even when life gets busy.

-

Invest Wisely: Once you’ve built an emergency fund and paid off high-interest debt, consider investing in stocks, bonds, or real estate. The earlier you start investing, the more you can take advantage of compound interest.

Stay Motivated and Be Patient

Becoming debt-free and achieving financial security doesn’t happen overnight. It requires time, effort, and consistency. Here’s how you can stay on track:

-

Set Goals: Establish clear financial goals for both the short and long term. Whether it’s paying off a specific debt, saving for a home, or building an investment portfolio, having a goal will keep you motivated.

-

Celebrate Milestones: Celebrate when you reach financial milestones, such as paying off a debt or saving a certain amount. Rewarding yourself in small ways will keep you motivated.

-

Stay Educated: Continuously educate yourself on personal finance. Read books, listen to podcasts, or consult with a financial advisor to keep your knowledge up-to-date and refine your financial strategies.