How to Plan for Long-Term Care Costs in Retirement

As life expectancy increases, more people are living longer, healthier lives. However, with longevity comes the potential need for long-term care (LTC) — assistance with daily activities such as bathing, dressing, eating, and medication management, often due to age-related health conditions or chronic illness. Unfortunately, Medicare doesn’t typically cover long-term care, and the costs can be substantial. This makes it essential to plan ahead for long-term care expenses to ensure you can maintain financial stability and quality of life in retirement.

Planning for long-term care (LTC) is a critical yet often overlooked component of retirement planning. In this article, we’ll walk you through key strategies to prepare for LTC costs and safeguard your financial future.

Understand the Costs of Long-Term Care

Before you can begin planning for long-term care, it’s important to understand the potential costs involved. The expenses for LTC can vary widely based on factors such as where you live, the level of care needed, and whether the care is provided at home or in a facility.

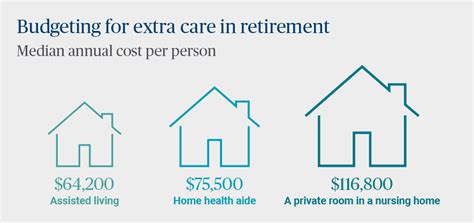

Typical LTC costs (2024 data):

- Nursing Home Care: The median annual cost of a private room in a nursing home is around $108,000 (based on 2023 national averages). A semi-private room can cost slightly less.

- Assisted Living: The average cost for assisted living is approximately $54,000 per year, depending on location and level of care.

- Home Health Care: Home care aides cost about $26 per hour, or roughly $52,000 annually for full-time care.

- Adult Day Care: For those who need part-time care during the day, adult day care costs around $19,000 annually.

These costs can quickly deplete retirement savings if not properly planned for, especially given the potential for long-term care needs to last for several years.

Evaluate Your Personal Risk and Needs

The next step in planning for long-term care is to assess your personal risk factors. Some individuals may need LTC due to family history, genetic predispositions, or chronic health conditions, while others may never require it. Consider the following factors:

- Family History: If you have a family history of conditions like Alzheimer’s, dementia, or chronic illness, you may be at higher risk for needing long-term care.

- Current Health: Chronic conditions like diabetes, heart disease, or arthritis can increase your likelihood of needing assistance as you age.

- Lifestyle: A healthy lifestyle — including regular exercise, a balanced diet, and avoiding smoking — can lower the risk of needing extensive care.

- Age: While the risk of requiring LTC increases with age, many people overestimate the need. It’s important to plan early, as the need for care can arise unexpectedly.

By understanding your own health risks, you can make more informed decisions about the type and amount of coverage you’ll need for long-term care.

Consider Long-Term Care Insurance

Long-term care insurance (LTCI) is one of the most common ways to prepare for the high costs of long-term care. LTCI helps pay for services like nursing home care, assisted living, and home health care. Policies vary widely in terms of coverage, premium costs, and benefit structure, so it’s crucial to carefully compare options.

Key considerations when buying LTC insurance:

- Coverage Amount: Determine how much coverage you may need based on the types of care you’re likely to require and the projected costs in your area. A policy may cover a daily or monthly benefit amount for a specified period (e.g., 3 years or lifetime).

- Elimination Period: This is the waiting period before the insurance kicks in. Policies often have an elimination period of 30, 60, or 90 days.

- Inflation Protection: Healthcare costs increase over time, so it’s wise to choose a policy with inflation protection to ensure the benefit amount keeps pace with rising costs.

- Premiums: Long-term care insurance premiums can be costly, and they increase with age. The best time to purchase a policy is in your 50s or early 60s, when premiums are more affordable, and you are still in good health.

Although LTCI can be expensive, it provides peace of mind knowing that long-term care costs will be covered without eroding your savings.

Consider Other Financial Tools and Strategies

If long-term care insurance is too expensive or not the right fit for you, there are alternative strategies and financial tools that can help cover the cost of LTC.

- Health Savings Accounts (HSAs): An HSA is a tax-advantaged account that allows you to save money for healthcare costs, including long-term care. While you can only contribute to an HSA if you have a high-deductible health plan (HDHP), it offers a triple tax advantage: contributions are tax-deductible, the account grows tax-free, and withdrawals for qualified medical expenses are tax-free.

- Annuities: Some annuities offer long-term care riders that provide additional benefits to help cover LTC costs. These products combine retirement income and long-term care coverage, although fees and benefits vary.

- Medicaid: Medicaid is a government program that provides health coverage, including long-term care, for low-income individuals. However, to qualify for Medicaid’s long-term care benefits, your income and assets must fall below certain thresholds, so this is often seen as a last resort. Some individuals use strategies like Medicaid planning to transfer assets and qualify for benefits.

Plan for the Impact on Your Retirement Savings

Even if you don’t purchase long-term care insurance or a related product, it’s essential to factor potential long-term care needs into your retirement savings strategy. These costs can dramatically reduce the longevity of your savings, so planning for them is crucial.

Strategies to safeguard retirement savings:

- Increase Retirement Savings: Start saving more toward retirement early on, aiming for a nest egg large enough to cover long-term care expenses. Consider contributing to retirement accounts like IRAs and 401(k)s, and be sure to factor in additional funds for potential healthcare needs.

- Diversify Investments: A well-diversified portfolio can help ensure you have the funds needed to cover both retirement living expenses and unexpected costs like long-term care. Work with a financial advisor to create an investment strategy that accommodates both growth and risk management.

- Plan for Spousal Care: If you are married, make sure your retirement plan accounts for the possibility that one spouse may need long-term care. In some cases, spouses can access certain benefits or insurance plans that can help provide for both individuals.

Consider Other Living Options

In addition to traditional nursing homes and assisted living, there are other living options that may reduce long-term care costs. Some of these options include:

- Aging in Place: If possible, you may be able to stay in your home with assistance from home health aides or family members. Making your home more accessible and modifying it to accommodate mobility issues can help you live independently for longer.

- Shared Housing or Co-Housing: Another option is shared housing, where you live with other seniors and share caregiving responsibilities or costs. This model has gained popularity as a way to reduce costs and maintain a sense of community.

- Continuing Care Retirement Communities (CCRCs): CCRCs offer a range of care options, from independent living to nursing home care, all within one community. They often require an entrance fee and monthly payments, but they provide a predictable long-term care option.

Final Thoughts

Long-term care costs can be one of the most significant financial challenges in retirement, but with careful planning, you can mitigate the impact on your finances. Start planning early by evaluating your personal risk factors, considering long-term care insurance, and exploring other financial tools like HSAs and annuities. By taking these steps, you can ensure that your retirement years are financially secure, even in the face of potential long-term care needs.

The key is to start planning now, rather than waiting until retirement is on the horizon. By making informed decisions, you can protect both your health and your wealth as you navigate the complexities of aging and long-term care.