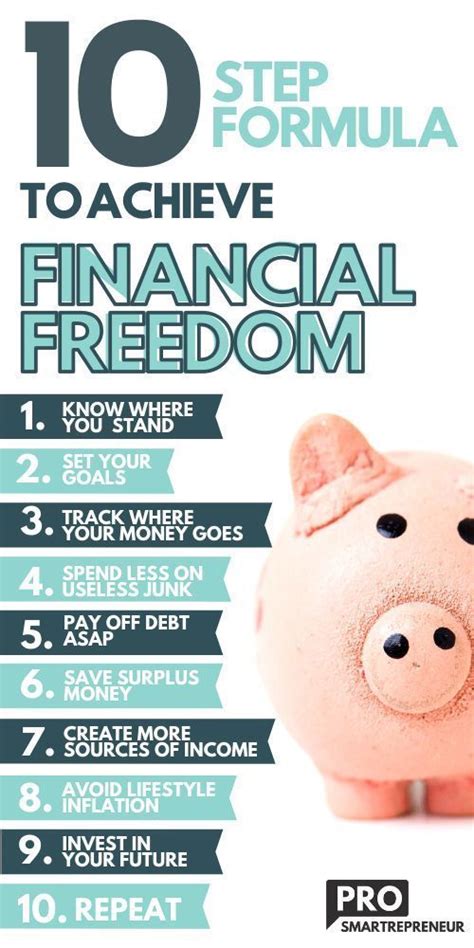

10 Simple Steps to Achieve Financial Freedom

Financial freedom is a goal that many aspire to but few truly understand how to achieve. It’s about more than just having enough money to pay your bills—it’s about creating a lifestyle where you can live comfortably, save for the future, and enjoy your life without being stressed about money. While it may seem like an elusive dream, financial freedom is achievable with the right mindset, tools, and strategies. Here are 10 simple steps you can take to set yourself on the path to financial freedom.

Set Clear Financial Goals

The first step to achieving financial freedom is setting clear and specific goals. What does financial freedom look like to you? Do you want to retire early? Eliminate debt? Build an investment portfolio? Write down your goals and break them into short-term and long-term objectives. Having clear, measurable goals helps you stay focused and motivated along the way.

Create a Budget

Budgeting is the foundation of financial freedom. By knowing exactly where your money is going each month, you can control your spending and make sure you’re prioritizing savings and investments. Start by tracking your income and expenses, categorize them (e.g., housing, food, entertainment), and set limits for each category. There are several apps and tools available to help make budgeting easier, but the key is consistency.

Build an Emergency Fund

An emergency fund is a financial safety net that will help you avoid going into debt when life throws unexpected expenses your way—whether it's a medical emergency, car repair, or job loss. Aim to save at least 3–6 months' worth of living expenses in an easily accessible savings account. This gives you peace of mind and keeps you from derailing your financial plans when emergencies arise.

Pay Off High-Interest Debt

Debt can be one of the biggest obstacles to financial freedom. High-interest debt, such as credit card balances, can quickly spiral out of control. Focus on paying off high-interest debt first, using strategies like the debt avalanche (paying off the highest-interest debt first) or the debt snowball (paying off the smallest debts first to gain momentum). Once your debt is paid off, you’ll be able to redirect those payments toward savings and investments.

Live Below Your Means

One of the simplest yet most effective ways to achieve financial freedom is by living below your means. This means spending less than you earn and resisting the temptation to buy things you don’t really need. It’s not about depriving yourself, but about prioritizing what truly matters. When you live within your means, you free up money that can be used to pay off debt, save, and invest.

Automate Savings and Investments

To make saving and investing a habit, set up automatic transfers from your checking account to your savings or investment accounts. By automating this process, you ensure that you’re consistently putting money toward your goals without even thinking about it. Even small contributions can add up over time, and automation makes it easier to stick to your plan.

Invest for the Long Term

Investing is a key strategy for building wealth and achieving financial freedom. While saving is important, investments such as stocks, bonds, real estate, and retirement accounts can help your money grow over time. Start by contributing to tax-advantaged accounts like IRAs or 401(k)s, and consider speaking with a financial advisor to build a diversified investment portfolio. The earlier you start investing, the more you benefit from the power of compound interest.

Increase Your Income

If you want to achieve financial freedom faster, consider finding ways to increase your income. This might involve asking for a raise, switching to a higher-paying job, or pursuing side gigs or freelance work. In today’s digital world, there are many ways to generate additional income streams, such as online tutoring, content creation, or starting an online business. By increasing your income, you can accelerate your debt repayment and investment contributions.

Stay Educated About Personal Finance

Financial literacy is essential to making smart decisions about your money. Take the time to educate yourself about topics like investing, taxes, retirement planning, and money management. There are countless books, podcasts, and online courses that can help you understand the basics of personal finance. The more you know, the better equipped you’ll be to make informed decisions that will lead to financial freedom.

Be Patient and Stay Consistent

Achieving financial freedom doesn’t happen overnight. It takes time, discipline, and consistency. It’s important to stay patient and trust the process, even when progress seems slow. Stick to your budget, continue saving and investing, and avoid making impulsive financial decisions. The key to financial freedom is persistence—small steps taken over time lead to significant results.

Final Thoughts

Financial freedom is a journey, not a destination. By following these 10 simple steps—setting clear goals, budgeting wisely, paying off debt, and investing for the future—you can build a strong foundation for long-term financial independence. It may take time and effort, but with persistence and dedication, you can achieve the peace of mind and security that comes with financial freedom. Start today, and watch your financial future transform.